#MoneyMovesMonday: The Importance of Investing Your Time

This week, I wanted to talk to you about investing.

But instead of starting with the traditional concept of investing (real estate, stocks, bonds, etc.), I wanted to talk to you about one of the most important concepts of investing that not a lot of people focus on…

Time investing!

To me, one of the most fundamental principles that people need to understand before they can make any kind of money move is that…

1. Time, not money, is one of the most valuable currencies we have.

How you spend your time not only dictates your financial wellness, but also your physical, mental, and emotional wellness too (and these are also areas of your life can also drastically hinder or improve your finances as well). Even though we all go back and forth on whether or not money can bring you happiness, just know that how you spend and invest your time definitely can!

2. Losing time is way more expensive than losing money.

So I have a little exercise for you that I got from The Psychology of Success by Alison and David Price (P.9). You can either follow the instructions below, or download the print out I have attached.

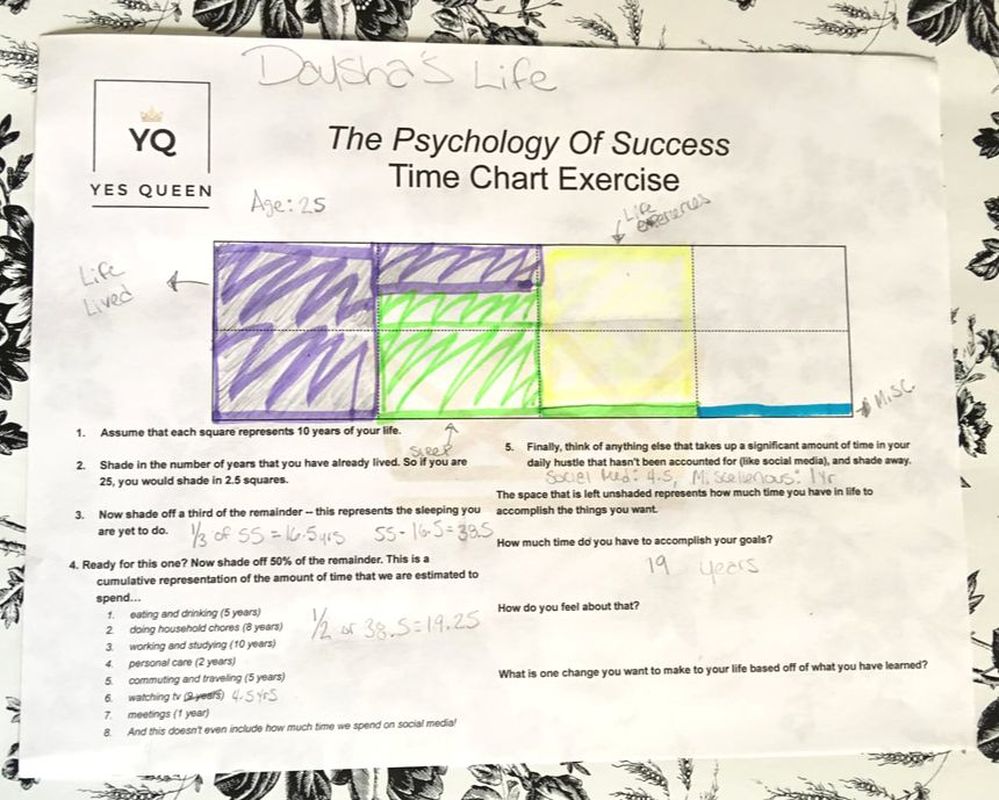

1. On a piece of paper, draw a rectangle with 8 squares in it.

2. Assume that each square represents 10 years of your life.

3. Shade in the number of years that you have already lived. So if you are 25, you would shade in 2.5 squares.

4. Now shade off a third of the remainder -- this represents the sleeping you are yet to do.

5. Ready for this one? Now shade off 50% of the remainder. This is a cumulative representation of the amount of time that we are estimated to spend...

eating and drinking (5 years)

doing household chores (8 years)

working and studying (10 years)

personal care (2 years)

commuting and traveling (5 years)

watching tv (9 years)

meetings (1 year)

(And this doesn't even include how much time we spend on social media)!

6. Finally, think of anything else that takes up a significant amount of time in your daily hustle that hasn't been accounted for (like social media), and shade away.

The space that is left unshaded represents how much time you have in life to accomplish the things you want.

So based off of what we have discovered doing this exercise, unfortunately, we don’t have as much time in life as we think we do to accomplish everything that we want out of our lives. I, for example, only have 19 years!

*Things to keep in mind...

Purple = life lived, Green = time asleep, Yellow = life experience, and Blue = miscellaneous

If you need to adjust the years for #4, remember that 80 = 100% because each box represents 10 years and there are 8 of them. So for instance, I don't watch a lot of tv, so I cut the number in half, then added up my total (35.5) and divided it by 80, which gave me 44% to shade in. However, because I knew that I was going to put that 4.5 years in for my social media usage, I just ended up shading in the 50% (19.25 years) and including social media in the yellow shaded part.

Fill everything in! (I know I didn't answer the last two questions, but that's because I've already done it).

And what makes time even more expensive than money is that when we lose money, we can always find another way to generate more money. But when we lose time, there’s no way to get that time back. Once it has been spent, it will be logged as the way that you spent that time forever.

I remember doing this exercise about a year ago, and getting hella anxious about being able to do everything that I want to do in life.

But instead of falling into the “analysis paralysis” trap, and overthinking this exercise to the point where I felt uninspired to do anything, I used the 4 Queen Commandments to help me make a choice that would allow me to invest my time, and eventually my money, more wisely.

Step 1: Clarity -- understanding the what and the why.

I want you to create a financial vision board. You can make it just a list on a sheet of paper, download the print out I have attached, or get super crafty and get poster board. But it needs to be written down or in a tangible form, otherwise you are drastically reducing the effectiveness of the exercise (and thus wasting more time)!

On your vision board, I want you to have at least 3 financial goals or visions of your financial future that you would like to accomplish in the next 3 months. Underneath each goal, write out why this goal is important to you, and your wellbeing. Now when you write out your goals, make sure they are SMART goals…

S- Small

M- Motivational

A- Actionable

R- Reasonable

T- Timely

You want your goals to be small enough so that you can actually complete them in the time that you have allotted, but then you also want them to be enough of a challenge so that you feel motivated to continue on the path of success. You want them to be action-oriented; so goals that actually require you to take a form of action that can be measured over a period of time for progress. You want them to be reasonable, so that you don't get discouraged or waste time doing something that was impossible to begin with. And finally, you want to make sure that your goal has a realistic chance of being completed in the amount of time that you have given it.

For example, a financial goal I have for myself and Yes Queen in the next 3 months is to create at least 1-2 passive income streams so that I can invest less mental energy into figuring out how to make money, and put more of my attention into being creative (and spending time with y'all)! I’ll explain more about passive vs active income streams a little later.

Examples of not SMART goals...

I want to pay off my credit card debt.

I want to start a business.

I want to plan for retirement.

You can use writing out goals like these as a starting point, but remember that we don't just want to have goals. We want to have SMART goals!

Examples of SMART goals...

I want to stop using my credit card, and put at least $200 towards paying it off each month for the next 3 months because the high interest rate on this card is taking away money that I could spend on going out salsa dancing.

I want to design a logo, draft up a mission statement, and purchase a URL for a business I want to start in the next two weeks because I am tired of working for someone else.

I want to find at least one retirement plan, and start investing 2% of my bi-weekly earnings into it because my grandparent didn't save well for retirement, and I don't want to struggle like they are.

When you think about establishing your why, consider the following questions…

Why is it important for me to do X in this moment? For example, we'll use paying off your credit card.

Is it because you don’t want to leave debt to your kids/family?

Is it because you hate how much you have to pay in interest?

Is it because it's impacting you from being able to do other things in your life (like lowering your credit score, which affects your ability to sign a lease or take out a loan)?

It it because it affects your emotional/mental wellbeing?

Is it impacting a relationship you have with a significant other/roommate?

We have to establish where the source of your stress/anxiety/motivation is coming from for achieving your goal so that when we plan out your course of action, we’ll know for sure that we’re doing something that will eventually provide you with relief. That in turn, should boost your confidence!

I also want you to make a list of things that you do that you think waste your time on (binge-watching shows all day, scrolling on social media for hours, mindless dating app swiping, etc) and estimate how much time you think you spend doing each activity. Feel free to download the worksheet below.

Step 2: Control -- creating the when and the how.

Once you have your financial vision board, we are going to take control over how you manage your time using the 3 Rs.

1. Redirect

2. Refocus

3. Recognize

Redirection: Underneath each goal on your financial vision board, write 2-3 actionable first steps you can make towards accomplishing it, and how long you think it will take you to complete them.

Going back to my example…

Goal: Generating 1-2 passive income streams, so that I can invest less mental energy into figuring out how to make money, and put more of my attention into being creative.

Step 1: Research and write out a list of at least 3 places that have products that you like to use, and that have influencer marketing programs where you could make money off of every time you mention the product (1-2 hours; 1 day completion).

Step 2: Apply or either contact the marketing departments of the 3 places by X day (1-2 hours; 1 day completion).

Refocus: Take your time-wasting list, and ask yourself how much time do you think you’d be willing to take from each activity to invest it into something more meaningful (research, making connections with people, etc). As you do this, remember to keep in mind why accomplishing this goal is important to you, and if you are repurposing enough hours from your time-sucking activities to properly invest in accomplishing your financial goal.

Recognize: If you want to be a boss queen that is financially independent, then it means that you will have to control of how you use your time, and do the work. Recognize that there will be times where you will be tempted to watch another episode of a tv show or some other time-sucking activity, but that in the long run of your life, investing your time in this type of activity will not get you any closer to your financial goals.

Step 3: Confidence -- thinking about where the moments of difficulty are.

Once you establish clarity and control, the next thing you want to think about and plan for are the potential areas for push back or conflict.

Create a two column list, and in the first column write down everything that you think could get in the way of you accomplishing your goal. In the second column, write out how you think you can avoid the conflict.

Conflict: I have a mild form of tendonitis in my left hand that limits how much time I can be on the computer.

How to avoid it:

Give myself 2 hours to accomplish my goal so I can take hand stretching breaks.

Try to use dictation software as much as possible.

The importance of doing this exercise is so that you can hush the inner/outer critics that make you want to second-guess doing your goals. By planning for the push back, it will make you feel much more confident in your ability to accomplish your goals because you’ll have a plan in place for if/when something starts to get in your way.

Step 4: Choices!

Now that you have your financial goals clarified, you have taken control over how you are going to reinvest your time, and you have established your confidence by planning for the potential push back, I hope you feel “powherful” enough to execute your choices!

I would love to check out your financial vision boards, and even share them if you’d like. So feel free to @ me on social media (@DayshaVeronica or @YesQueenLife)! You can also send me an email (yesqueen.info@gmail.com) if you want to keep it private.

Daysha's Last Thoughts...

I hope you enjoyed this week's advice, and that you walk away with at least these key things.

1. Time is HELLA Expensive

So try to figure out how to evenly distribute how much time you allocate to certain activities like Netflix, and social media, so that you can reinvest that time into other things that can make you money!

2. Since we don't have as much time as we think we do, let's invest on making more SMART goals for ourselves.

S- Small

M- Motivational

A- Actionable

R- Reasonable

T- Timely

3. The "powher" of our financial choices is up to us, so don't be afraid to use tools like the 4 Queen Commandments to help you stay on track!